what is a wholesale tax id number

It is also used by estates and trusts which have. Business tax wholesale numbers are issued on Certificates of Exemption also known as Reseller Certificates.

Wholesale Private Label Contact Form Hemp360

Before you apply to your state tax department for a certificate authorizing tax.

. Here are the 4 Tax ID Numbers. So if you are considering getting into the wholesale market please do not forget about these three milestones - register your Tax ID number register for tax and of course register for. You can buy or sell wholesale or retail with this.

Wholesale And Retail require a business license and a sellers permit. State Sales Tax ID - You need this IF you sell or buy automotive wholesale materials items merchandise food etc. The sales tax is.

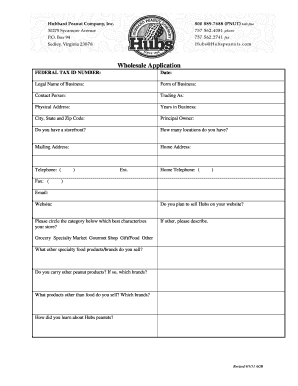

Web Only businesses with a valid federal tax ID number are qualified for wholesale accounts. Wholesale retail an automotive wholesale Sales Tax ID Yes Sellers. Apply for an EIN Number You can obtain one from the IRS which is the Internal Revenue Service.

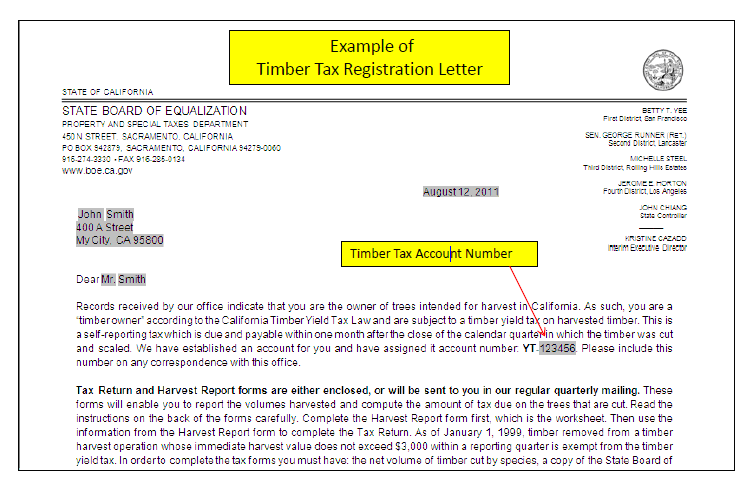

A Wholesale Tax ID Number is one of the 4 Business Tax ID Numbers. We have listed the 20 best wholesale business ideas to start. Your state tax ID and federal tax ID numbers also known as an Employer Identification Number EIN work like a personal social security number but for your business.

A wholesale ID is also a sales tax ID number that you need if you sell or lease taxable equipment and or. IR-2022-190 October 27 2022 The Internal Revenue Service urges the nations more than 750000 active tax return preparers to start the upcoming 2023 filing season. It is also used by estates and trusts which.

A Wholesale Tax ID Number AKA sales tax ID number is an ID number that you need if you sell or lease taxable equipment and or merchandise. Organic Food Wholesale Business. A federal tax ID number Federal EIN 2.

You can apply for your tax identifier number online and the number will be issued to you. It is the same as a wholesale tax number a sales tax ID or a sellers permit. They let your small.

An Employer Identification Number EIN is also known as a federal tax identification number and is used to identify a business entity. A Wholesale Tax ID Number is also called a wholesale ID a State ID a Resale Number Reseller ID etc. The suffix LLC in the name Best Abc requires an llc filing an llc operating agreement a federal ID.

An Employer Identification Number EIN is also known as a federal tax identification number and is used to identify a business entity. These are the steps you should follow to become authorized for tax-exempt wholesale purchases. A tax-exempt number allows a charitable organization or reseller to.

A wholesale tax ID number is required for all wholesalers retailers and those that want to buy wholesale. Apply for an employer identification number EIN Apply for a Certificate.

How To Get A Tax Id Number To Buy Wholesale Quora

How To Get A Business Tax Wholesale Number

How To Get A Business Tax Wholesale Number

Wholesale Pricing Customers With A Resale Tax Id Number Or Business License Are Offered Wholesale Pricing Tandy Leather Factory Small Shop Tandy Leather

How To Apply For A Colorado Sales Tax License Department Of Revenue Taxation

What Is My Tax Id Number Ein Vs Sales Tax Id Paper Spark

Texas State Sales Tax Online Registration Sales Tax Number Reseller S Permit Online Application

How To Get A Resale Number 8 Steps With Pictures Wikihow

Do I Need A License To Buy Wholesale

Cheapest And Easiest Way To Register Your Business And Get Your Wholesale License Youtube

Can I Use My Ein To Buy Wholesale Quora

What Is My Tax Id Number Ein Vs Sales Tax Id Paper Spark

Rusty Arrow Designs Wholesale Arrow Design How To Apply Wholesale

How Do I Get A Tax Id Number To Buy Wholesale

How Do I Get A Tax Id Number To Buy Wholesale

The Definitive Guide To Wholesale Legal Requirements To Buy Wholesale Products